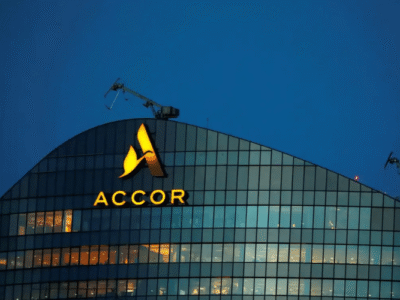

After a three-year break, the state oil company Saudi Aramco has returned to the debt market with the completion of the offering of an international bond valued at $6 billion US dollars.

The offerings, which started on July 9 under the business’s Global Medium Term Note program, will be traded on the London Stock Exchange, the company disclosed in a Tadawul release.

Aramco last made use of the debt market to raise $6 billion through a three-tranche sukuk, or Islamic bond, in 2021.

In light of the falling global interest rates this year, Middle Eastern governments and businesses have been keen to take advantage of debt markets. Saudi Arabia released $12 billion in bonds denominated in dollars in January as part of this trend.

“We are pleased with the strong interest and level of engagement from investors globally, both existing and new,” stated Ziad T. Al-Murshed, executive vice president and chief financial officer of Aramco. At its height, our order book was over $33 billion, demonstrating Aramco’s remarkable financial resiliency and strong balance sheet.

“We have proven our unique credit proposition by achieving a negative issue premium across all tranches,” he continued. Our goal is to sustain a solid investment-grade credit rating throughout economic cycles. We have continuously proven our financial discipline while generating shareholder value and corporate growth.

Aramco revealed that a minimum subscription of $200,000 will be required for the bonds.

Also Read:

CEO: Saudi Arabia’s Tharwah will Increase its Reach with $13 Million from the Nomu Offering

Lilium Signs Agreement to Provide Saudi with Electric Vertical Takeoff and Landing Aircraft