According to Reuters, oil prices dropped in Asia on Friday as remarks made by a Federal Reserve official supported the belief that rates would remain higher for an extended period. This belief will be tested when the highly anticipated US inflation report is released.

The market was pressured overnight by an unexpected increase in US gasoline stocks as traders awaited an OPEC+ decision on production cuts over the weekend.

US West Texas Intermediate crude dropped 10 cents, or 0.13 percent, to $77.81, while Brent futures were down 3 cents, or 0.04 percent, to $81.83 per barrel at 9:01 a.m. Saudi time.

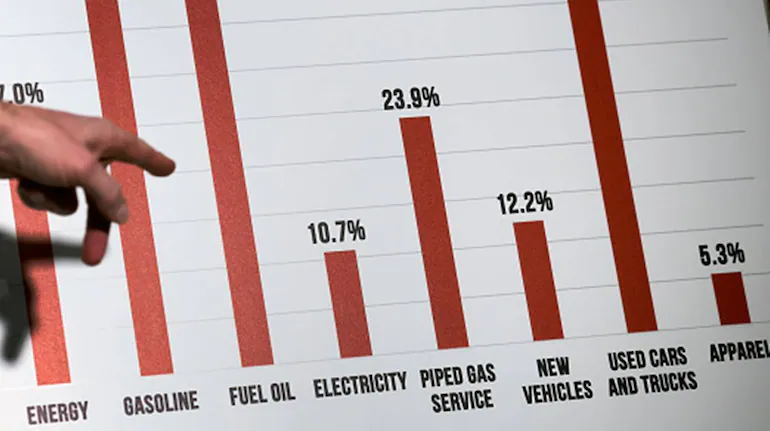

Despite the recent easing, Dallas Federal Reserve President Lorie Logan expressed concern about upside risks to inflation. It warned that the US central bank must remain adaptable and keep “all options on the table” as it monitors data and decides how to act.

At an El Paso, Texas, gathering, Logan stated, “It’s really important that we don’t lock into any particular path for monetary policy.” “I don’t think it’s appropriate to consider rate reductions just yet.”

Market strategist Yeap Jun Rong of IG stated that investors are cautious about releasing a significant US inflation indicator on Friday. Later in the day worldwide is the deadline for the Fed’s preferred inflation index, the personal consumption expenditures report for April.

Also Read:

Saudi Arabia Seeks to Boost Economic Growth by fortifying Industrial Ties With the Netherlands.

ROSHN, Owned by PIF, Renovated the Jeddah Waterfront